The Victoria Housing Reserve Fund grants for the development of affordable housing.

Eligibility

Eligible applicants must be either:

- a registered non-profit society

- partnered with a registered non-profit that will own and operate the housing

If you are not a registered non-profit, please contact the City of Victoria. Staff can help determine eligibility prior to applying.

The program guidelines provide more detail on eligibility. If you are unsure, or you have questions, please contact the Community Planning Division at housing@victoria.ca. A pre-application meeting is strongly encouraged.

Victoria Housing Reserve Fund Guidelines

Applications

There are two annual intake dates:

- March 31

- September 30

Applications submitted on, or before, each deadline will be evaluated at the same time. The following documents will help you build your application:

Funding

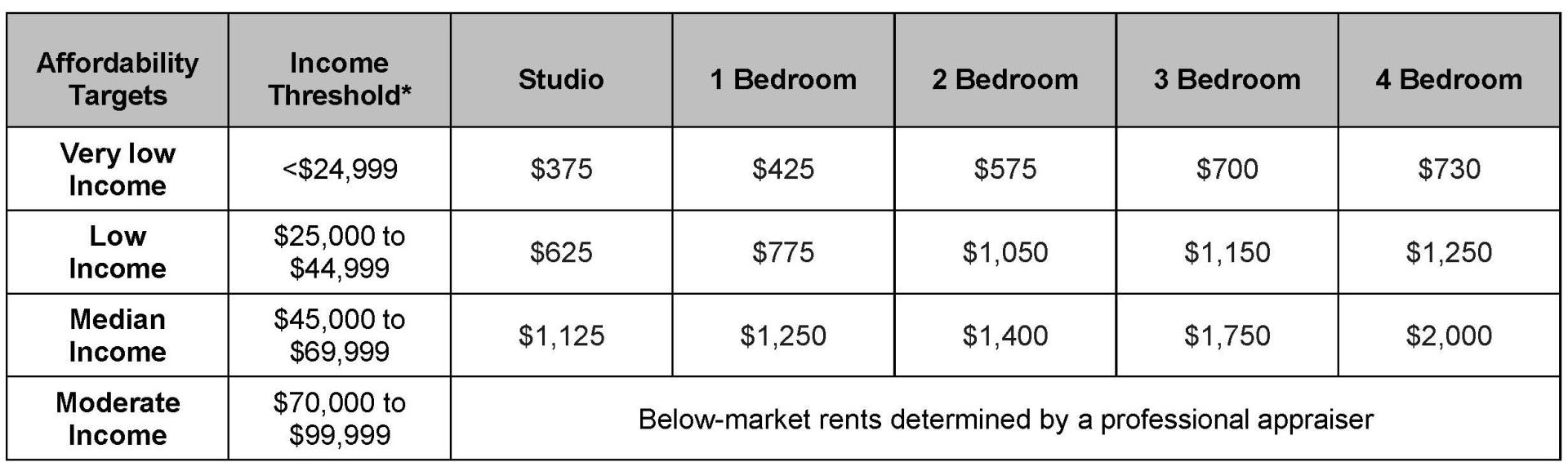

This program uses the following definitions from the Victoria Housing Strategy’s Phase Two: Housing Affordability Targets.

Important Notes

- all projects are eligible for funding only once, and the grant is non-renewable

- an approved grant may be rescinded if:

- construction of a project does not begin within two years of a Development Permit

- a Development Permit is not issued within two years of Council’s grant approval

- the City reserves the right to accept or reject any application or to grant funding differently from the funding framework above without limitations

- all housing projects are required to pay development cost charges

- to demonstrate that projects meet all requirements, the City publishes project eligibility information from applicants, including:

- completed application checklist

- Letter to Mayor and Council describing the project and how it aligns with the Victoria Housing Reserve Fund Guidelines

- completed application form

- building and site plans

Additionally, at Council’s discretion, each application may be considered on a project basis. This includes affordable homeownership projects that achieve median income target thresholds or Housing Income Limits (HILs) rates. Typically, units must be offered at a minimum targeting median income and HILs rates. Greater consideration is given for maximum grant funding for projects that offer better affordability.

Guideline Updates

Recent updates to the guidelines include:

- Elimination of the $500k cap for maximum grant amount

- New below-market unit funding category

- Updated priority populations and project priorities to reflect Equity, Diversity and Inclusion policy

- Adjusted Grant Payment Schedule to provide more support prior to construction

- Alignment with CMHC Co-investment program for median income unit funding

- Additional funding support for four-bedroom units